Health Conditions Most Affected by High Drug Prices

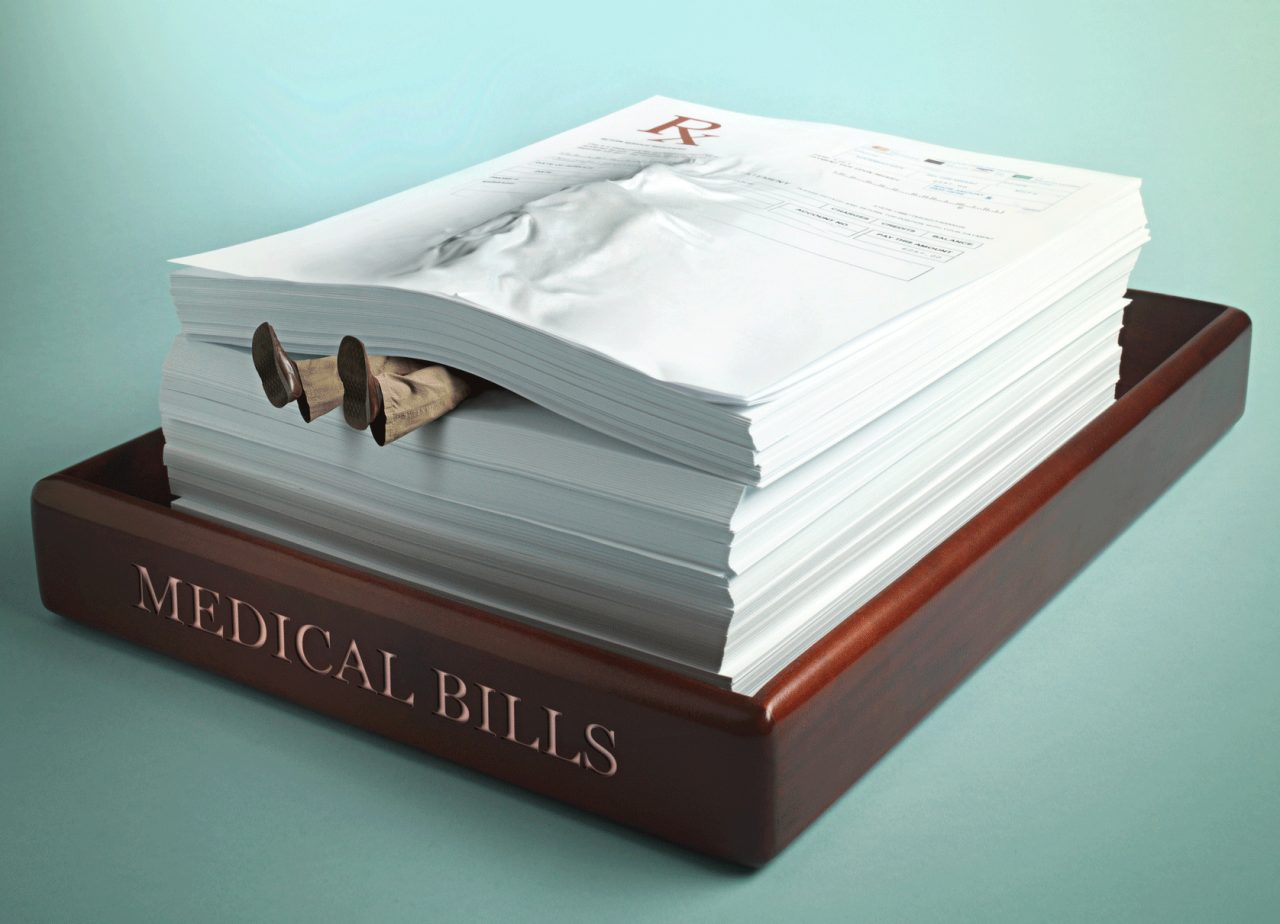

For people who need prescription drugs, especially for chronic health problems, soaring drug prices can have a devastating and, sometimes, even a deadly effect.

If you take a prescription drug and the price goes up a few dollars, that’s usually not a big problem. But what happens when prices soar for medications you need to treat a health condition — or even to save your life — and you have no insurance, or a high deductible you can’t afford, or your policy doesn’t cover the drugs you need?

Unfortunately, the consequences can be serious for many people with health conditions most affected by high drug prices.

A study headed by Duke University and National Institutes of Health researchers concluded there are about 125,000 deaths in the U.S. each year as a result of people not taking needed prescribed drugs. While there can be many reasons for medication non-compliance, there’s little doubt some Americans are so impacted by rising drug costs they simply cannot pay for their meds.

This problem, known as “medication insecurity,” has risen dramatically over the past year. By the end of 2019, almost 23 percent of adults “couldn’t pay for needed medicine or drugs that a doctor prescribed,” according to research from Gallup and West Health.

The health conditions most affected by high drug prices are often chronic, and some can be deadly if not treated properly with adequate medication. In fact, about 34 million people told Gallup researchers they know at least one friend or family member who died in the past five years after not receiving needed medical treatment — including prescribed drugs — because they were unable to pay.

YOU MIGHT ALSO LIKE: The Most Expensive Drugs in 2020

Why high drug prices mean high risk for some conditions

According to research from NPR, the Robert Wood Johnson Foundation and the Harvard T.H. Chan School of Public Health, many Americans report that their insurance plans sometimes don't cover a drug they need. So, when this is the case, nearly half the people this happens to simply don't fill their prescriptions because they can’t afford the cost of their drugs.

For some people, whose health problems require specific medications to save their lives, the result can be tragic.

For example, one of the biggest drug price increases over the past few years has been linked to the deaths of several people with type 1 diabetes. Unlike type 2 diabetes, which is primarily a disease of lifestyle (linked to being overweight and sedentary) and can be treated with lifestyle changes and oral medications, lif needed, type 1 diabetes is an incurable autoimmune disease.

In type 1 diabetes, the pancreas produces no, or almost no, insulin (the hormone that regulates blood sugar). Without daily insulin injections in the right amount to replace the missing hormone, type1 diabetics cannot survive.

News report have recounted examples of how people who simply didn’t have the money for their insulin, or who tried to ration how much they took — or who turned to cheaper insulin alternatives — ended up dying.

Case in point: The price of insulin in the U.S. has more than doubled since 2012. That tragically put the life-sustaining hormone out of reach for Alec Raeshawn Smith of Richfield, Minn., a young man with type 1 diabetes. When he turned 26 and was no longer covered under his mom’s health insurance, he learned his diabetes supplies would cost $1,300, with insulin making up most of that amount.

Alec’s $35,000 a year salary was too high for Medicaid help or for any assistance from Minnesota’s health insurance subsidies, his mom explained in an NPR report. He finally got insurance, for a $450-a-month fee and an annual deductible of $7,600.

He simply did not have enough money for the insurance payment plus the cost of the insulin he needed before reaching his deductible. So, Alec tried to ration his insulin. He was found dead in his apartment, three days before his pay day. The cause was diabetic ketoacidosis. Without enough insulin, his blood sugar levels had spiked so high his body shut down.

The price of another life-saving medication, injectable epinephrine, is now also out of the reach for many people. EpiPens (the best known brand-name of auto-injectors) quickly and automatically saves lives by injecting the hormone epinephrine, also called adrenaline, to shut down the severe allergic reaction known as anaphylaxis, which can lead to the inability to breathe, severe drops in blood pressure, and death.

Having an EpiPen or the equivalent always nearby allows a person at risk for anaphylaxis — or the parent of a child at risk — to quickly inject the life-saving epinephrine in case of an allergy emergency.

A two pack of the auto-injectors cost about $94 in 2007. However, when the drug company Mylan bought the device, the cost skyrocketed and is now over $700. What’s more, not all insurance plans cover EpiPens or other auto-injectors.

NPR reported the case of an elderly but still active woman, Sally Radoci, with a life-threatening allergy to bee stings. Her doctor prescribed an EpiPen for her to keep on hand. Although she has Medicare and supplemental insurance, Radoci’s drug plans denied coverage for the device. She cannot afford the prescribed brand-name EpiPen, nor the generic version, which costs about $400. All she can do is avoid bees as best she can, knowing a sting could kill her quickly.

YOU MIGHT ALSO LIKE: How to Lower the Cost of an EpiPen

How high drug prices can affect cancer patients

Cancer treatment often involves more than chemotherapy, surgery, and radiation. Advances in cancer therapy have led to dozens of immune system modulators, targeted therapies, and other prescribed oral medications cancer patients take to help keep malignancies at bay and often prolong their lives.

However, the price of oral cancer drugs has increased substantially over the past decade, according to a study by Vanderbilt and Harvard researchers published in JAMA. And when you take into consideration the enormous costs of some these prescription drugs, patients with insurance requiring high deductibles can be faced with financial difficulties trying to pay for these important medications.

In addition, Medicare beneficiaries not yet qualifying for catastrophic help with drugs may also not be able to afford oral cancer drugs.

It’s true that Medicare's Part D drug program's "donut hole" — a stage in Medicare coverage where beneficiaries were previously responsible for all of their drug costs until they reached a certain threshold — has closed. Medicare enrollees, however, now enter a “coverage gap” instead of the “donut hole,” where they pay 25 percent of drug costs until spending $6,350 out-of-pocket [DE10] for drugs 2020. At that point they move to catastrophic Medicare drug coverage and pay only five percent.

But when you consider that drug price increases mean 48 out of 54 oral anticancer medications now cost more than $10,000 monthly — in fact, 21 cost more than $15,000 per month — the amount cancer patients must still come up with for their medication can be considerable, a report in AARP explained.

Pam Holt, a retired school principal, is an example of the financial toll the high cost of cancer drugs can have. She told AARP how she planned for her retirement and had only three more years before her home mortgage would be paid off. Then she developed cancer. After a stem cell transplant, Holt was prescribed a drug to hopefully keep her in remission. The price had severe financial ramifications.

The medication cost was $11,000 a year and, even after paying thousands of dollars until her Medicare Part D copay went down when she reached the catastrophic stage of Medicare drug coverage, she still had to pay $640 a month for her crucial medicine. She was stretched so thin financially due to her first year’s out-of-pocket cost for her cancer medicine, Holt ended up getting by with charging on credit cards until she finally had to refinance her home in order to survive financially.

Chronic health problems affected by high drug prices

There are a host of chronic health problems people live with for years that can be helped, relieved, and sometimes prevented with prescription medications. For example, cholesterol-lowering drugs and medications to treat high blood pressure can help prevent heart attacks and strokes, and anti-coagulants can reduce the odds a person with atrial fibrillation will have a stroke.

But people need to take these medications regularly. When high drug prices cause problems for those who can’t afford their co-pays or don’t have insurance, then often wind up skipping doses or not taking needed drugs at all.

“It is those with specialty problems that run into trouble — rheumatological disease, other autoimmune diseases, or advanced heart disease,” Carolyn McClanahan, MD, a Florida-based doctor, explained in an interview with CNBC.

McClanahan, who is also a financial advisor, notes people needing regular prescription drugs should look into options to lower drug prices, like getting a usually less costly 90-day prescription instead of only a 30-day supply.

That’s not always a solution for cash-strapped people, however, including seniors who often have health conditions most affected by high drug costs. Elders are most likely to have certain chronic conditions, such as osteoarthritis or high blood pressure — and even fairly low deductibles may stress seniors financially, especially if they need multiple drugs. Again, the result can be skipping doses or not taking drugs they need at all.

According to the AARP, some of the highest price hikes for drugs seniors commonly take include the blood thinner Eliquis (up six percent) and Humira for rheumatoid arthritis, which has increased over seven percent. Other widely prescribed medications whose prices have gone up around five percent include Benicar, used to treat high blood pressure, Lyrica, prescribed to treat nerve pain, and Januvia for type 2 diabetes.

Prescription costs are rising much faster than inflation growth, CNN reported. And for seniors and others with limited financial resources who opt to skip their medications, the result can be an unfortunate immediate or long-term impact on many health conditions.

Research from the Centers for Disease Control and prevention shows not taking prescribed medications to treat chronic diseases can actually increase overall health care costs in the long run because skipping the drugs you need now can impact medical conditions and result in the need for more expensive treatments later. Not taking medications as prescribed can contribute to higher healthcare costs for emergency room visits, hospitalizations, and complications from your condition.

Talk to your pharmacist about lower-cost options for your medication, or contact the pharmaceutical company and ask about discount and patient-assistance programs.

Updated:

August 19, 2020

Reviewed By:

Janet O’Dell, RN